As of July 31, 2025 (Valid for Next 24 Hours)

Timeframe: 4H

Trade Bias: LONG

Strategy Type: Breakout Continuation

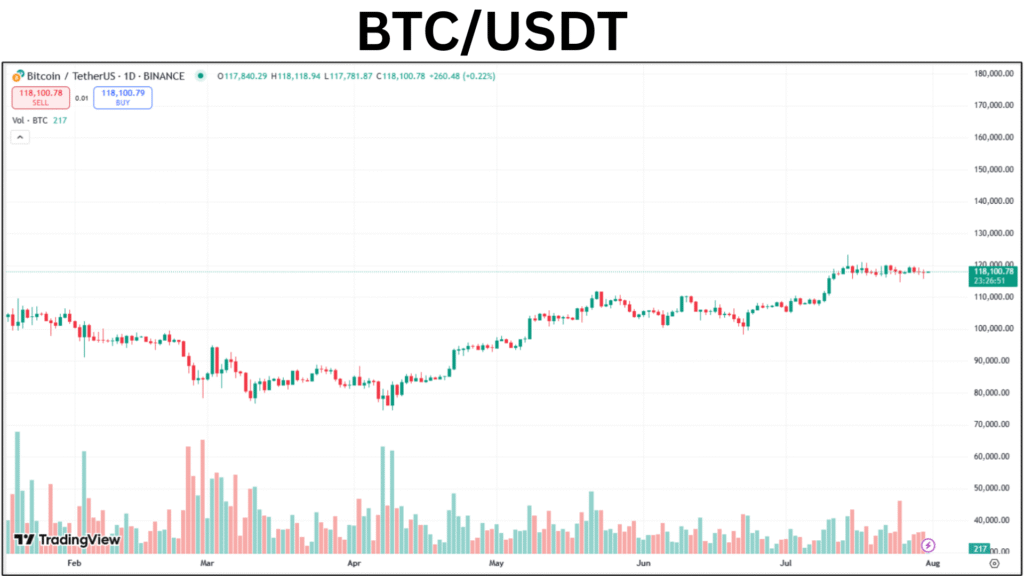

Bitcoin is currently moving sideways in a tight range between $115,000 and $120,000. It’s a classic consolidation phase, neither a strong entry point nor a clear rejection. For now, the chart signals a bullish bias, but a long trade should only be considered if price confirms a breakout above $120K.

Market Overview

| Factor | Signal | Details |

|---|---|---|

| Trend | Bullish | Higher lows since June; price holding above $115K support |

| Market Structure | Range-bound | Sideways movement between $115K and $120K—no breakout yet |

| Momentum (RSI) | Neutral | RSI around 50 shows balance—no dominant buying or selling pressure |

| Funding Rate | Positive | Slight bullish sentiment in the derivatives market |

| Volume | Low | No significant spike—no confirmation for strong move yet |

Trade Setup (If Breakout Confirms)

This is a breakout-only trade idea, no position should be taken unless BTC breaks through the $120K ceiling with confirmation.

Entry Criteria:

- A 4H candle must close above $120,000

- Entry is triggered at $120,500 for confirmation

| Parameter | Value |

|---|---|

| Direction | Long |

| Entry Price | $120,500 |

| Take Profit 1 | $123,300 |

| Take Profit 2 | $125,000 |

| Stop Loss | $117,800 |

| Risk/Reward | Approx. 1:2.1 to 1:2.5 |

| Risk Per Trade | 1–2% of total capital |

Trade Rationale

BTC remains in a broader uptrend, rising steadily since the June low of $98K. The current range between $115K–$120K forms a bullish flag, a continuation pattern that often precedes another leg up.

Here’s why this setup stands out:

- Price has respected support at $115K, suggesting strong demand.

- A neutral RSI (~50) indicates potential energy building up for a directional move.

- Funding rates remain positive, hinting at a bullish lean across derivatives platforms.

- A breakout above $120K is likely to trigger liquidity grabs and breakout momentum, possibly driving price toward $123K–$125K.

Risk Management Guidelines

- Stop-loss at $117,800 ensures protection in case of a fake breakout.

- If BTC falls back below $120K after entry, partial or full position reduction is recommended.

- Once price approaches $121,800 or TP1, consider moving stop to breakeven to lock in gains.

This is a precise, breakout-driven trade setup with a clear invalidation level.

- Trade Type: Long (only if breakout confirms)

- Entry: $120,500 after 4H close above $120K

- Targets: TP1 = $123,300 | TP2 = $125,000

- Stop Loss: $117,800

- Signal Validity: Next 24 hours

- Important: Do not enter unless price breaks and closes above $120,000

Disclaimer:

This analysis is shared purely for educational purposes and should not be taken as financial advice. Always do your own research and evaluate the risks before entering any trade. We are not encouraging or motivating you to trade, and any decisions you make are entirely your responsibility. Trading involves risk, and we are not liable for any profits or losses that may occur as a result of your actions.