Bitcoin has been stuck in a tight range, but there are signs that a breakout could be just around the corner. While it briefly dipped below $116,000, key data suggests that the larger move is still in the works.

Key Points:

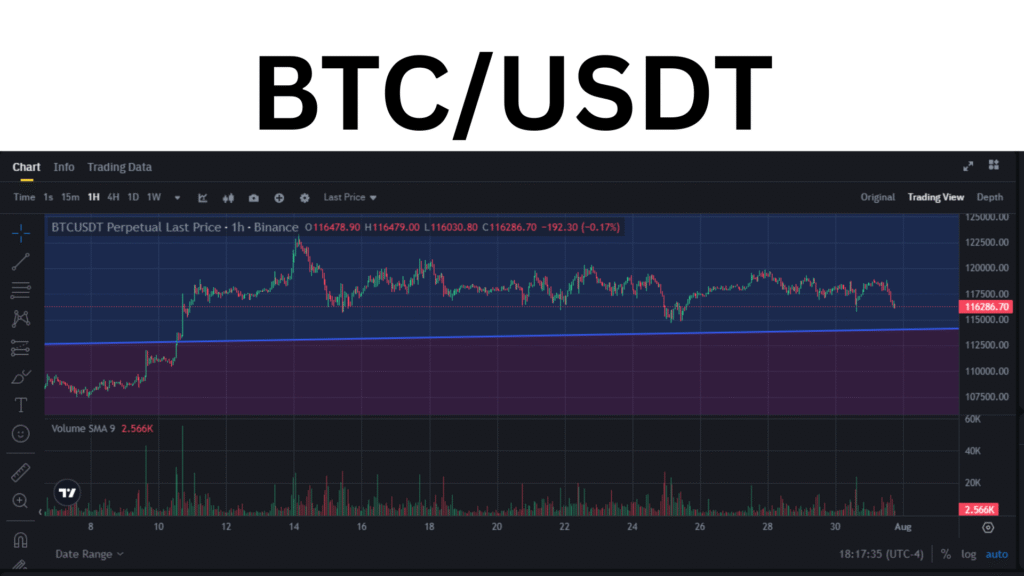

- Bitcoin remains in its 18-day range, despite a dip below $116,000.

- Tension is rising among traders due to the uncertainty between pro-crypto policies and Bitcoin’s price movements.

- While Bitcoin saw a sharp drop below $116,000 earlier this week, the rebound on Thursday shows that markets are still focused on the long-term fundamentals.

The Range Continues

Bitcoin’s price briefly sold off on Wednesday after the Federal Reserve’s FOMC minutes were released. Fed Chair Jerome Powell explained why the central bank chose not to cut interest rates, which triggered the sell-off. However, after the dust settled, Bitcoin rebounded, and US equities and crypto markets refocused on longer-term economic factors, particularly President Trump’s economic policies.

Despite this brief dip, Bitcoin continues to trade between the $115,000 and $121,000 range, which has now lasted for 18 days. But the pressure is building, and data indicates that a breakout may be on the horizon.

Liquidity and Market Pressure

Hyblock Capital analysts noted that the price action around the FOMC minutes was driven by liquidity hunts. They pointed out a “classic indecision candle” that reflected market uncertainty. The analysts also highlighted a key metric—the bid-ask ratio—which had turned red, indicating that Bitcoin was nearing a liquidation level at $115,883.

Looking at liquidation data from Binance and Bybit, Bitcoin’s price still remains in a holding pattern. Short positions are at risk of getting liquidated if the price rises above $120,000, while long positions face liquidation risks below $115,000. The current range and liquidation levels are keeping traders on edge.

TRDR’s aggregate orderbook data further shows sell walls thickening around $121,100 and significant bids forming around $111,000. These factors suggest that both sides are gearing up for a move, but the direction remains unclear.

An Imminent Breakout?

While the market has focused on Bitcoin’s downside, several positive factors remain in play. Charles Edwards, founder of Capriole Investments, pointed out that Bitcoin treasury buyers have increased over the past six weeks, with more than three companies buying Bitcoin daily. He noted that there are currently 100 buyers for every seller per month, indicating strong demand for Bitcoin.

Additionally, Bitcoin’s spot ETF inflows have picked up after a brief outflow period. Since July 23, Bitcoin ETFs have seen a net inflow of $641.3 million, despite Bitcoin’s recent price drop. This suggests that institutional interest is still strong, even if short-term price action is volatile.

Positive Developments on the Regulatory Front

This week’s White House crypto report and SEC Chairman Paul S. Atkins’ speech laid out a clear set of objectives for the growth of cryptocurrency in the U.S. While these policies may not immediately impact prices, they set a foundation for broader adoption. More importantly, they send a signal to institutional investors that the U.S. government is prioritizing the cryptocurrency sector.

While Bitcoin’s immediate price action might be influenced by liquidity hunts and uncertainty in the markets, the long-term outlook remains bullish. As treasury purchases rise, ETF inflows continue, and regulatory clarity increases, Bitcoin could be poised for a breakout soon.

Bitcoin’s range-bound movement is frustrating traders for now, but the data suggests a larger move could be coming. Whether it’s to the upside or downside remains to be seen, but the foundation for a breakout is certainly building.